How to List a Token or Coin on Deepcoin: Step‑by‑Step Guide

October 22, 2025

October 22, 2025 Updated: October 23 2025, 09:22

Updated: October 23 2025, 09:22

LEAVE A REQUEST

Launching your own token project? Our experts are ready to help with listing on exchanges, market making, marketing and other solutions

SUBMIT APPLICATIONDeepcoin is an international cryptocurrency exchange that attracts both traders and project teams. For projects, listing on Deepcoin means entering a professional trading environment where liquidity, visibility, and compliance all matter. This guide explains how to prepare for the listing process, where to find the official Deepcoin listing application, and what steps follow after submission. It also outlines what the team should do after the token is listed, including liquidity management, marketing, and community support.

Why Deepcoin?

Deepcoin focuses on a clean trading experience for both beginners and professionals. The exchange combines spot and derivatives markets in one interface, offers web and mobile apps, and provides basic analytics so teams can plan liquidity and users can trade comfortably.

Security and compliance are core principles. The platform applies KYC and AML checks to reduce fraud risks, and it publishes updates through verified official channels. Projects can use the help center to learn how listings work and how to contact the listing team for follow-up questions.

Asset Support & Launch Options

Deepcoin supports a wide variety of digital assets across multiple blockchain networks, including popular standards such as ERC-20 and BEP-20. The exchange regularly expands its list of supported tokens, focusing on projects that show real market activity, transparent tokenomics, and a clear use case.

Most listings start with standard spot trading pairs where users can buy and sell tokens directly. Later, depending on performance and demand, a project may also be integrated into other Deepcoin products such as derivatives or promotional campaigns. In some cases, teams can apply for participation in Launchpad or partnership programs that aim to boost visibility and trading volume during the initial stages.

Before applying, it is always important to review the current list of supported assets and check which networks and trading pairs are available. This helps avoid technical issues during integration and ensures that the application package meets Deepcoin’s latest requirements.

Listing Requirements & Preparation Package

Before submitting the application to Deepcoin, a project must prepare a full documentation package. The review process includes technical, legal, and market evaluation. Having a complete and well-structured package helps speed up due diligence and improve the chances of approval.

The exchange checks not only token data but also the team’s transparency, legal structure, and community activity. Projects that provide clear and verifiable information usually pass the review faster and face fewer follow-up questions.

Due Diligence Checklist

Due diligence means a background review of the project before listing. The Deepcoin team checks the whitepaper, tokenomics, and all public materials to confirm that the project is legitimate and consistent.

The basic documentation package usually includes:

- Whitepaper and roadmap with clear goals and use case

- Tokenomics table with total supply, vesting, and allocation details

- Official website and active social media accounts

- Information about the team and legal entity

- Smart contract audit report

- Contract address and network details

- Disclosure of investors and previous fundraising rounds

Providing complete and consistent data at this stage significantly shortens communication and review time.

Technical Readiness

Technical readiness shows that the token can be safely integrated into the Deepcoin trading system. Projects must provide smart contract details, including network type, decimals, and total supply.

Deepcoin supports multiple blockchain networks such as Ethereum and BNB Chain. It is also important to prepare information about deposits, withdrawals, and trading pairs the project expects to launch. Teams that already have a market maker or liquidity plan should include these details in the application.

Compliance and Legal Basics

Every listing goes through a compliance review. Deepcoin checks that the project complies with KYC and AML principles and is not connected to any sanctioned jurisdictions or restricted activities.

Teams must confirm that they have legal rights to use their brand name and token symbol.

How to Submit: Deepcoin Listing Application

- Prepare the documentation package: collect all core materials in one folder. You need a whitepaper, a simple one-pager, a tokenomics table with total supply, allocation, and vesting, links to the website and social media, legal entity details, team contacts, the smart contract address with network and decimals, and at least one audit report if available. Add a short liquidity plan that explains who will provide the market making and what pairs you expect to launch. Make sure every number in the deck matches the numbers on the website and in the contract.

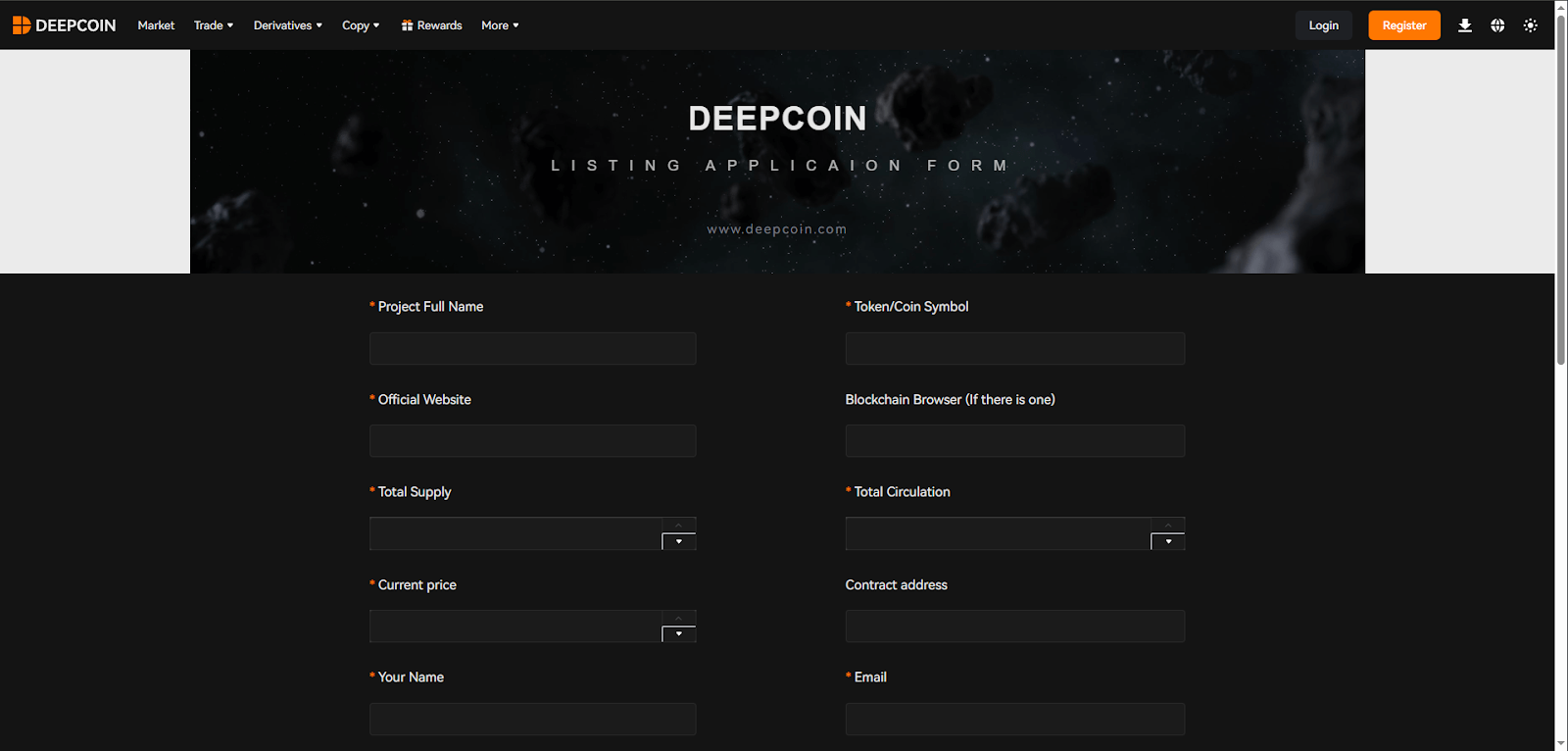

- Fill out the official application form. Enter the company name, legal contacts, token symbol, contract address, networks, and links to your documents. Double check the spelling of the contract and the decimals. Attach files in common formats, and keep names clear and readable.

- Respond to due diligence questions: after submission the listing team reviews your data. They may request clarifications on token distribution, investor rounds, cap table, brand rights, or any past incidents. Be ready to provide confirmations from auditors and to explain how you manage treasury wallets and unlocks. Quick and clear replies help shorten the review.

- Discuss commercial terms and sign agreements: if the project passes internal checks you move to the commercial stage. Financial terms are negotiated individually. The exchange sends draft agreements and security requirements. Read every clause carefully and align the public disclosure plan with your legal team before signing.

- Complete technical integration: provide technical contacts and test deposits and withdrawals on the chosen networks. Confirm ticker, trading pairs, precision, and symbol display. Share your API and price feed preferences if needed. Prepare incident response contacts for launch week.

- Plan announcements, deposits, and the start of trading: agree on dates for the listing timeline. Usually it includes a joint announcement, the opening of deposits, and the trading start. Prepare user guides that explain how to deposit the token and how to find the pair. Coordinate visuals and key messages to avoid conflicting numbers.

- Execute the launch and monitor performance: publish the announcements, open deposits, and go live. Track liquidity, spreads, and support tickets during the first days. Keep a daily report that covers volumes, depth, user questions, and any technical issues.

Timelines, Fees & Communications

The Deepcoin listing process does not have a fixed timeline because every project is reviewed individually. The duration depends on the completeness of the documentation package, the speed of communication, and the project’s technical readiness. On average, the initial review takes several weeks, but projects that submit all documents correctly often move faster through due diligence.

Financial terms and listing fees are discussed privately between the project and the exchange. Deepcoin does not publish standard prices or guarantees, as each listing agreement depends on multiple factors such as token type, network integration, and marketing commitments.

Community Role & Demand Signals

Community activity plays an important role in the Deepcoin listing process. The exchange often evaluates how engaged the project’s audience is and how clearly the team communicates updates. Strong, transparent communication helps Deepcoin understand the real demand for the token and the size of its user base.

Projects should prepare short educational posts or videos explaining the token’s purpose and how it will be traded on Deepcoin. Creating an FAQ and answering community questions before the listing helps reduce confusion at launch. Gathering feedback and addressing common concerns shows maturity and builds trust with both users and the exchange team. Another important signal of demand is organic trading activity or mentions across crypto platforms. Projects that demonstrate steady user interest and social activity usually get more visibility during internal evaluation.

Post-Listing Playbook

Once the token is listed on Deepcoin, the main goal shifts from preparation to maintaining activity and liquidity. The project team should plan several post-launch actions that support trading volumes, educate users, and keep communication consistent. Start with coordinated announcements across your official channels and Deepcoin’s media platforms. It is useful to publish short tutorials that show users how to deposit and trade the token. Joint AMA sessions or interviews help strengthen visibility and create trust between the team and the community.

Maintaining liquidity is another key task. Projects often cooperate with professional market makers to stabilize spreads and ensure smooth order book depth. Regular reports on performance, updates about ongoing development, and transparent communication will keep users engaged long after the listing.

How Listing.Help Supports You

Listing.Help provides professional assistance to crypto projects that plan to list their tokens on exchanges such as Deepcoin. The team helps structure all documents, verify data, and communicate with the exchange during each stage of the process. This support is especially valuable for projects that want to avoid any high costing mistakes.

Readiness audit

The Listing.Help’s specialists check your smart contract, tokenomics, and documentation to ensure that the project meets the technical and compliance standards required by exchanges.

Launch liquidity and market making

Through partner networks, the team helps connect projects with trusted market makers to secure stable liquidity at launch.

Marketing and community activations

Listing.Help assists with joint announcements, AMA sessions, and PR campaigns to build awareness before and after the listing.

Post-listing support

After launch, the team helps synchronize the token’s data with platforms like CoinMarketCap and CoinGecko, monitors performance, and advises on further optimizations.

Working with Listing.Help allows project teams to save time and reduce the risk of mistakes when navigating complex listing procedures.

Common Mistakes That Delay Listings

Many listing delays happen because projects rush to submit their applications without proper preparation. The most common issue is incomplete documentation or inconsistent information across materials. Even small discrepancies between the whitepaper, tokenomics, and smart contract can trigger additional verification steps and slow down approval.

Another frequent problem is weak communication. Some teams do not respond quickly to due diligence requests or provide unclear answers. This creates uncertainty and forces the exchange to pause the process. Lack of an audit report, poorly maintained social media, and unverified contacts also signal low project readiness.

Overpromising timelines or expecting instant approval is another mistake. Deepcoin carefully evaluates each submission, so teams should plan realistic launch schedules and be ready to refine their materials when asked.

Conclusion

Deepcoin offers a clear and structured process for listing your token on the exchange. This system is suitable for both new projects and experienced teams that value transparency and direct communication. To enter the market quickly and gain community trust, you need to prepare the documentation, check your smart contract, and respond promptly to all review requests. When every step is handled carefully, the listing process moves smoothly and without unnecessary delays.

For teams that want to complete the procedure quickly and confidently, it is worth contacting the specialists at Listing.Help. The team helps projects prepare all materials, communicate with the exchange, and manage post-listing activities.

February 2, 2026

February 2, 2026