CoinDCX Listing Requirements and Criteria 2026 (Full Guide)

November 23, 2025

November 23, 2025 Updated: January 4 2026, 09:07

Updated: January 4 2026, 09:07

LEAVE A REQUEST

Launching your own token project? Our experts are ready to help with listing on exchanges, market making, marketing and other solutions

SUBMIT APPLICATIONIntroduction

CoinDCX, India’s largest and most compliant crypto exchange, has built a strong reputation for security, regulatory alignment, and transparency.

A listing on CoinDCX can open a project to one of the fastest-growing user bases in Asia — but India’s regulatory environment makes preparation especially important.

This guide covers CoinDCX’s 2026 listing requirements and criteria, outlining what projects must prepare to meet its compliance, security, and liquidity expectations.

What Are the CoinDCX Listing Requirements?

CoinDCX applies strict multi-stage evaluations that focus on legality, technology, and market strength.

1. Legal and Regulatory Compliance

- The project must operate through a verifiable legal entity with transparent ownership.

- Founders and executives undergo KYC/KYB verification under India’s AML and FEMA regulations.

- The token should not violate local securities or currency laws.

- Clear documentation of business registration, ownership, and operational jurisdiction is required.

CoinDCX maintains a “Compliance First” policy aligned with India’s Financial Intelligence Unit (FIU) and crypto tax rules — projects must be ready to provide full disclosures.

2. Smart Contract and Security Verification

- All tokens must pass an independent audit (CertiK, Hacken, PeckShield, etc.).

- The audit report must demonstrate zero critical vulnerabilities and evidence of fixes.

- Projects must submit integration documentation, smart-contract addresses, and admin-privilege transparency.

- Code open-sourcing and bug-bounty programs are considered a plus.

3. Tokenomics and Financial Transparency

- Clear description of total and circulating supply, vesting schedule, and token use cases.

- Evidence of organic market demand and liquidity planning.

- Sustainable emission rates and fair distribution models.

- Token must not feature hidden taxes, backdoors, or inflationary risks.

4. Market Readiness and Community

- Active user base and organic traction across platforms (CEXs, DEXs).

- An active community with many users on X, Telegram, and/or Discord.

- India-focused educational or community efforts are considered positive signals.

5. Team and Governance

- Public founders, real company presence, and structured governance frameworks.

- Transparency in investor updates, treasury policies, and roadmap execution.

CoinDCX Listing Criteria Explained

CoinDCX uses both quantitative and qualitative metrics to evaluate listing readiness.

Innovation and Usefulness

CoinDCX prefers projects that contribute meaningfully to blockchain adoption in DeFi, infrastructure, or fintech applications.

Security and Risk Control

Full third-party audits, code verification, and ongoing monitoring are mandatory.

Projects with bug bounties or on-chain transparency tools gain higher trust.

Compliance and Regulatory Standing

Projects that operate within global AML/FIU frameworks and are transparent with tax and reporting obligations are prioritized.

Liquidity and Community Strength

Proof of organic liquidity, stable order books, and strong marketing efforts help ensure long-term viability after listing.

How to Apply for Listing on CoinDCX in 2026

The application follows a structured compliance-driven workflow:

- Prepare the Listing Package

Include whitepaper, tokenomics, legal registration, audit reports, community stats, liquidity and marketing plans. - Submit to CoinDCX’s Official Contact

Applications are accepted via the exchange’s official partnership or business inquiry channels. - Compliance & KYC/KYB Review

CoinDCX performs identity checks, FIU compliance, and background screening. - Technical Integration and Audit Validation

Contract compatibility (ERC-20/BEP-20), wallet setup, and infrastructure testing. - Market Review and Approval

Evaluation of token liquidity, trading demand, and compliance readiness.

Once approved, listing details are finalized and announced.

For a step-by-step walkthrough, see our full article.

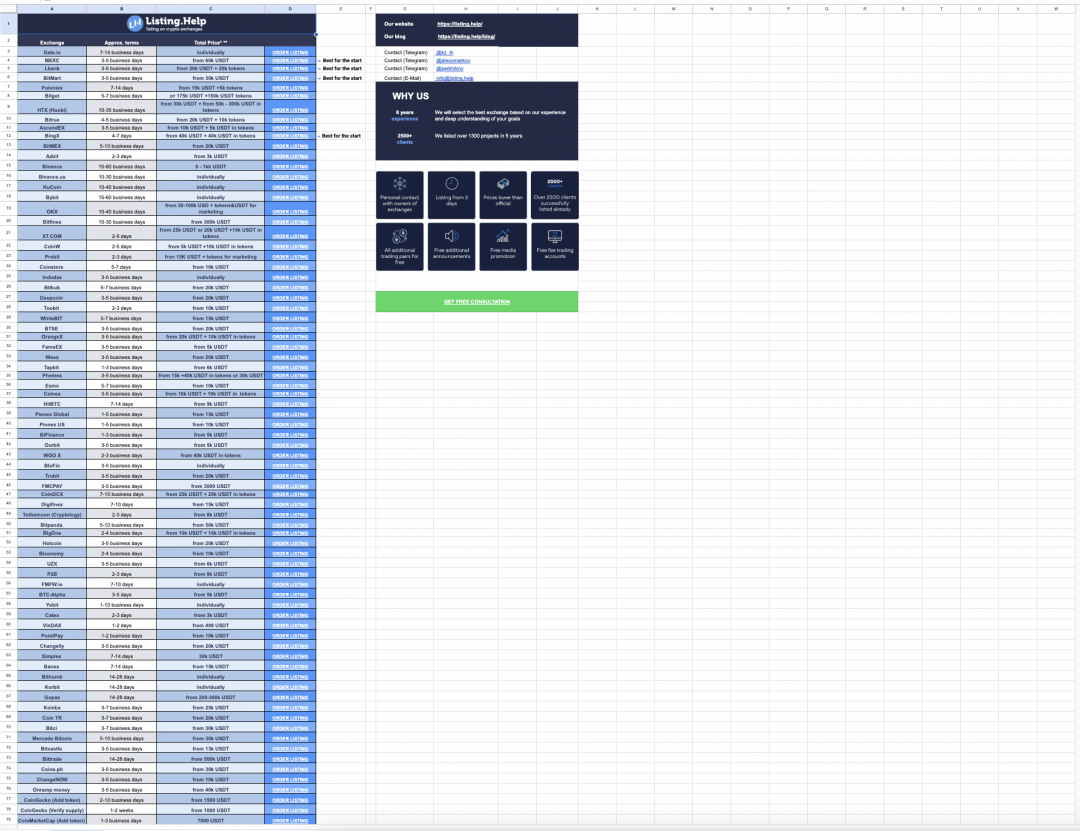

Professional Support with Listing.Help

Listing on CoinDCX requires detailed documentation and strict compliance.

Listing.Help, an experienced crypto listing agency, assists projects in preparing complete, regulator-friendly packages — including legal, technical, and market documents aligned with CoinDCX’s policies.

The agency helps streamline communications, shorten review cycles, and ensure the entire process is accurate and transparent.

Key Factors That Increase Approval Chances

- Audited and publicly verifiable smart contracts.

- Transparent tokenomics and clear legal ownership.

- Active, compliant user community.

- Documented liquidity and market making strategy.

- Proactive compliance readiness under Indian AML and FIU rules.

Common Reasons for Rejection

- Anonymous or unverifiable team members.

- Missing audit reports or unresolved vulnerabilities.

- Incomplete KYC/KYB or unclear legal entity structure.

- Tokenomics not matching compliance standards.

- Low liquidity or non-transparent investor disclosures.

Conclusion

Listing on CoinDCX allows projects to tap into one of the most regulated and fastest-growing crypto markets.

However, CoinDCX’s focus on compliance and transparency means only well-prepared and trustworthy projects succeed.

Working with Listing.Help helps teams organize documentation, align with compliance requirements, and improve their overall approval chances.

February 23, 2026

February 23, 2026