How to List Token or Coin on CoinDCX: Requirements & Steps

September 28, 2025

September 28, 2025 Updated: September 29 2025, 12:24

Updated: September 29 2025, 12:24

LEAVE A REQUEST

Launching your own token project? Our experts are ready to help with listing on exchanges, market making, marketing and other solutions

SUBMIT APPLICATIONAbout CoinDCX

In this article, we will take a detailed look at how CoinDCX ensures the security of its users, examining the key aspects it focuses on and the steps it takes to maintain its reputation in the market. We will walk you through the process of listing your token on this exchange step by step and help you avoid mistakes that could cost you a lot of time and money.

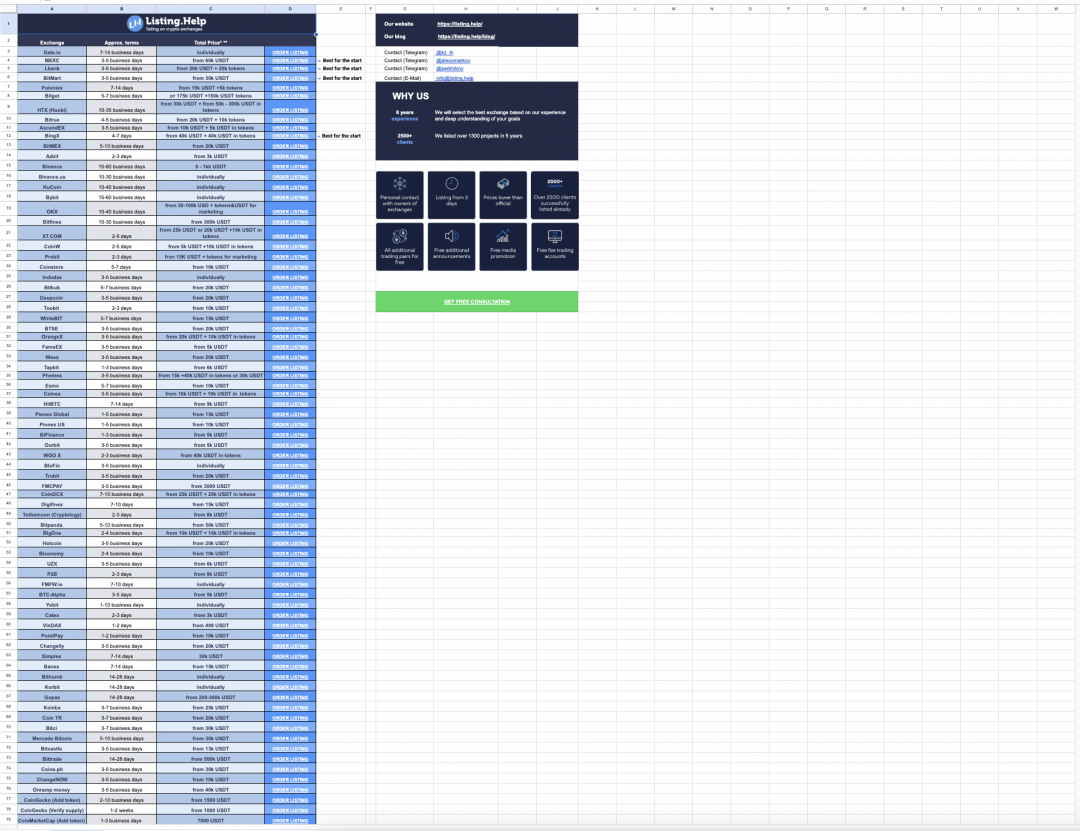

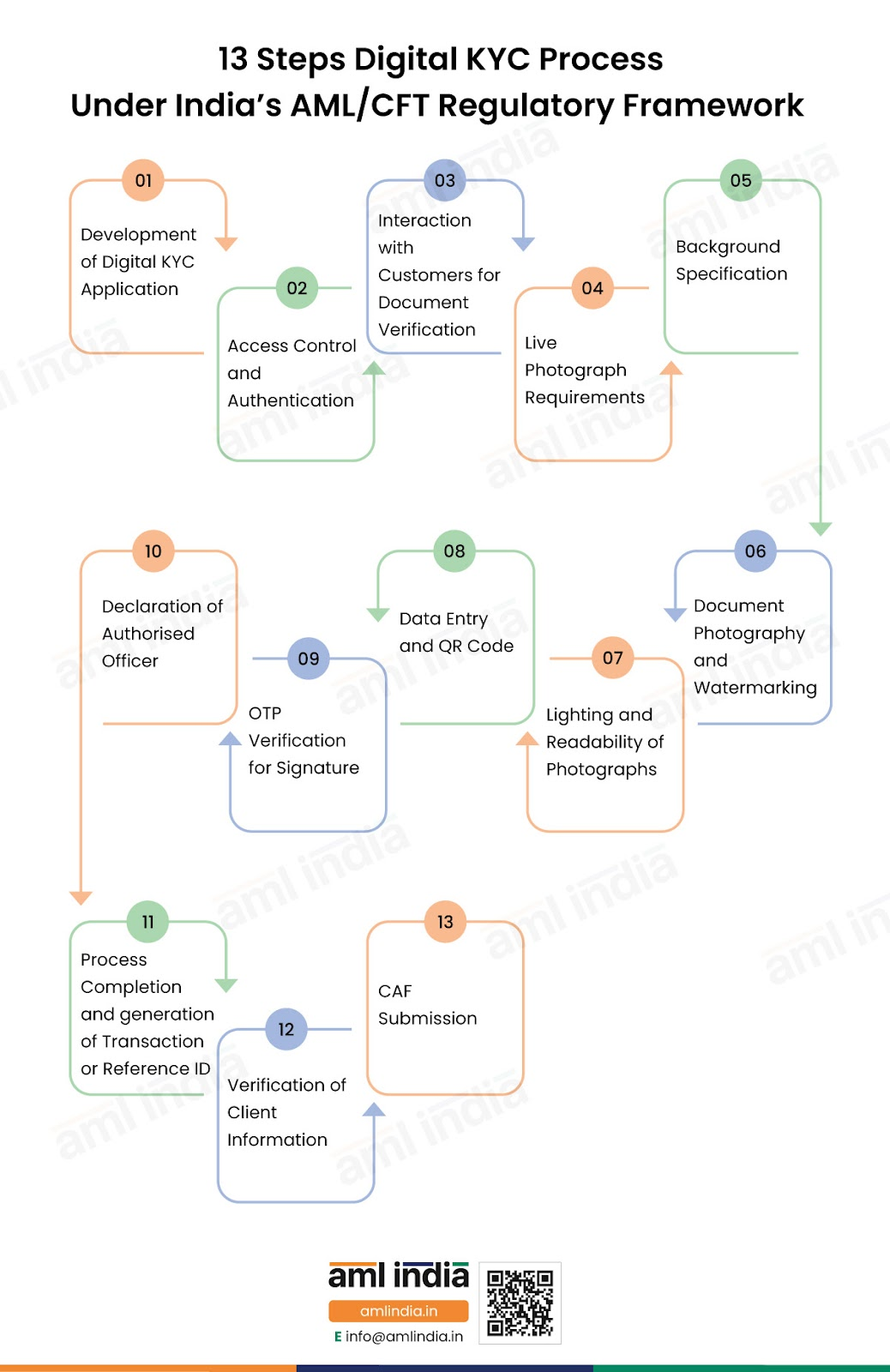

India Compliance Primer

CoinDCX operates under Indian law, so every project that wants to enter the Indian market must register with FIU-IND. This includes you in the register of organizations required to comply with AML requirements. There are basic requirements for projects that receive reporting entity status (you become part of a huge financial monitoring system):

- KYC/AML procedures: full customer identification, monitoring system

- FIU-IND reporting: reports on large transactions, suspicious transactions, maintenance of customer and transaction records.

- Internal control and staff training

KYC process in accordance with AML regulations

INR Rails & Order Books on CoinDCX

Since the exchange is Indian, the main focus is on trading pairs with the national currency INR. Therefore, when listing a token on CoinDCX, it is worth considering trading against INR right away. An important detail is how users deposit funds on the exchange. There are four methods in total:

- IMPS (Immediate Payment Service) — fast transfers, available 24/7, but with limits usually up to INR 200k (~$2.4k) per transaction.

- NEFT (National Electronic Funds Transfer) — batch payments, almost no limits, but not always instant.

- RTGS (Real Time Gross Settlement) — for large amounts, almost instant, operates during banking hours.

- UPI (Unified Payments Interface) — the most popular method, but transfers small amounts.

When listing, you also need to consider the methods of fiat deposit in order to build the right market making strategy. Since UPI is the most popular method of fiat deposit, liquidity

will appear in small batches, which means that the token will be illiquid at the beginning of trading.

What to Prepare Before Applying

What documents to pay attention to when submitting an application to list your project on the CoinDCX exchange. There are some very simple but important points:

- Tokenomics: you need to provide complete information about the token, how many tokens are currently in circulation, what is the maximum number, the token unlock schedule for the team and investors

- Smart contract audit: the exchange must be confident that there are no vulnerabilities in the code; sometimes a report is required if any vulnerabilities are found, as well as confirmation that these vulnerabilities have been fixed.

- Legal opinion: this is a document from a licensed law firm stating that the token is not considered a security under the laws of the selected country.

- Team KYC: Founders and key team members must undergo a full KYC passport and address check. If the team is public and has social media accounts, this is even a plus.

- Website / Whitepaper / Socials: Everything is simple here: the website is functional, the whitepaper clearly describes the tokenomics and utility of the token, and social media shows your active position to the audience.

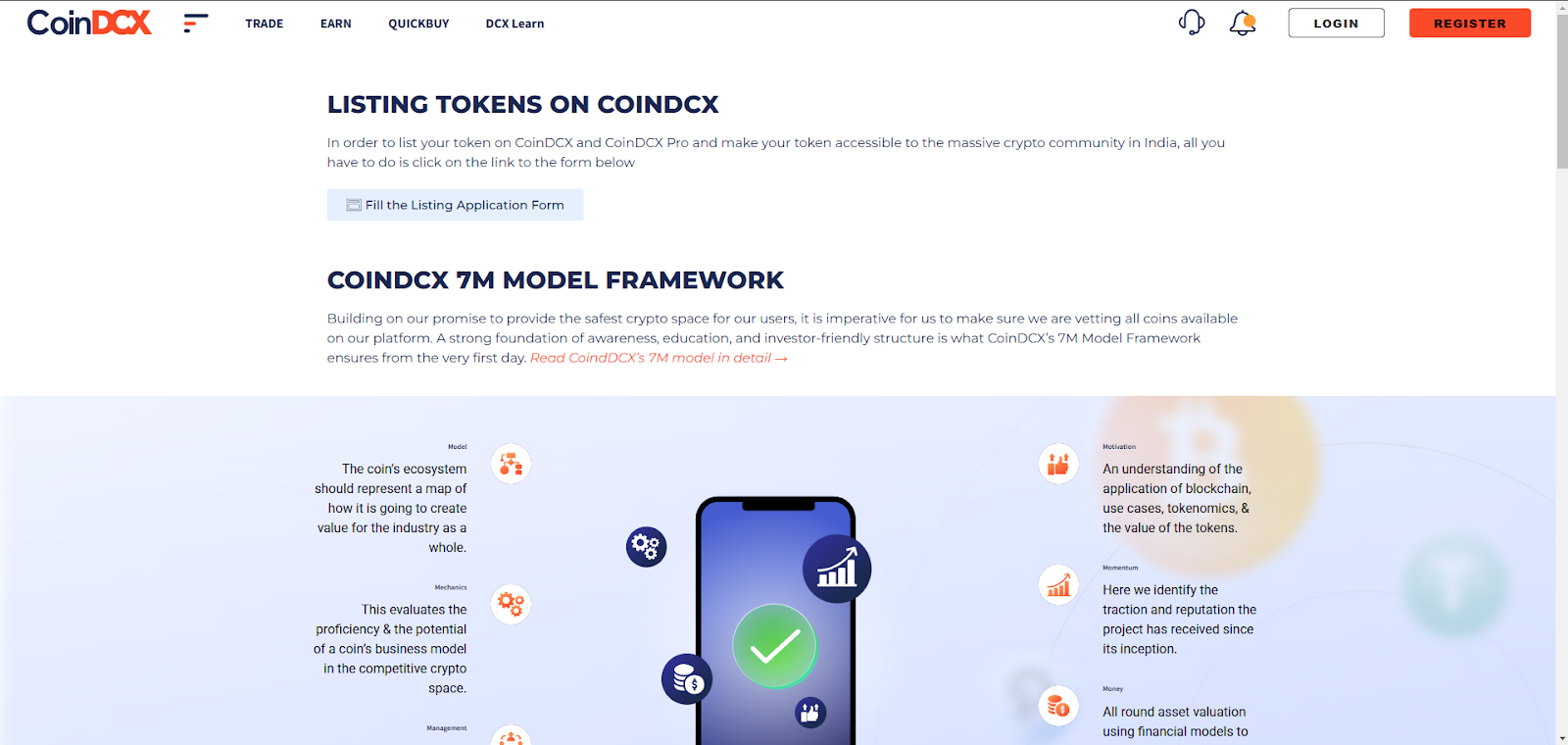

How to List on CoinDCX — Step by Step

Now let’s take a step-by-step look at the process of listing a project on CoinDCX

- There are three ways to apply for listing: through the official form on the website; direct contact with the listing team; or using the services of Listing.help

- The exchange conducts a basic review of the project, known as due diligence. After this review, the exchange begins to ask clarifying questions, such as how liquidity is ensured, whether there are market makers, and which markets are already connected.

- After that, the technical integration of your token into the CoinDCX ecosystem begins: wallet compatibility checks, smart contract integration, test deposits/withdrawals.

- And at the end, they start launching trading announcements. There is also the possibility of joint marketing of the project and the exchange.

Liquidity Strategy for INR Pairs

You can choose which pair to start trading with, INR or USDT. You can start trading in both pairs, USDT and INR, at once, but you need to understand that retail traders are used to the national currency. When listing, you need to understand what your goals are in terms of spread depth. Ideally, the depth of the order book should be 50-100 thousand, and the spread should be in the range of 2-3 percent. Exchanges actively monitor metrics on trading pairs: trading volume, number of active orders, and transaction frequency. Therefore, the project itself needs to monitor these indicators so that there are no questions. Be sure to take care of having a market maker, as this allows you to “revive” trading on your token, thereby increasing user confidence.

CoinDCX Web3 & Okto vs CEX Listing

In Web3 mode (Okto), CoinDCX connects tokens through a built-in non-custodial wallet and DEX aggregator, rather than through the CEX core. Before adding, only a security & safety audit of the smart contract is performed: checking for basic vulnerabilities, network compatibility, and liquidity in the DEX pool. This allows the token to appear in the application interface and be available for swaps, but does not open INR/USDT pairs, deposits, and withdrawals. In contrast, CEX listing requires full due diligence: KYC of the team, disclosure of tokenomics, audit with corrections, legal opinion, and an agreement with the exchange. In addition, CEX imposes market-making obligations — order book depth, spread, daily volumes. Therefore, the appearance of a token on Okto cannot be called a listing on CoinDCX; it is more like access through the Web3 catalog. To get a real listing on CoinDCX Spot, a project must pass regulatory and legal verification within the framework of FIU-IND standards.

Common Issues & How to Avoid Them

A few words about common mistakes made by projects that want to list their token on the CoindDCX exchange and how to avoid these mistakes.

Mistake: Insufficient disclosure of tokenomics and audits.

How to avoid it: Prepare a complete unlock schedule, token distribution, and final audit without critical vulnerabilities right away.

Mistake: Non-compliance with AML/KYC requirements.

How to avoid it: Conduct KYC for the entire team, obtain a legal opinion, and write an AML policy in advance.

Mistake: Underestimating the impact of TDS (1% tax on each transaction).

How to avoid: Plan turnover taking into account a decrease in activity and set up bonus programs for traders.

Mistake: Errors in PR and timing.

How to avoid: Coordinate announcements with the exchange.

CoinDCX Listing Checklist

We have prepared a handy checklist, with step-by-step instructions on how to prepare your project for listing on CoinDCX.

| Item | Owner | Status | Notes |

|---|---|---|---|

| Team KYC | Founders / Core Team | ☐ | Full identity verification of founders and key members (passport, address, background check). |

| Legal Opinion | Legal Counsel | ☐ | Document confirming token is not a security; compliance with PMLA/FIU-IND. |

| Smart Contract Audit | Tech Lead / External Auditor | ☐ | Final audit report with no critical vulnerabilities; top auditors preferred (CertiK, PeckShield, Hacken, etc.). |

| Tokenomics Disclosure | Tokenomics Lead | ☐ | Circulating supply, max supply, vesting schedule, unlock dates. |

| Data Room | Project Ops | ☐ | Centralized repository with documents: whitepaper, pitch deck, audits, legal opinion, tokenomics. |

| Market Making Plan | Liquidity Manager / MM Partner | ☐ | KPIs for order book depth (≥$100k ±2%), spread ≤0.3–0.5%, daily volume targets. |

| INR Onramps Readiness | Ops / Exchange BD | ☐ | Support for IMPS/NEFT/RTGS/UPI, awareness of limits, clear user instructions. |

| PR & Marketing Plan | Marketing / PR Lead | ☐ | Align announcement timeline with CoinDCX; distinguish Web3/Okto access from CEX listing. |

| Support & SLAs | Customer Support Lead | ☐ | Prepare FAQ and service-level agreements for user support during listing launch. |

| Technical Integration | Tech Lead + CoinDCX Tech | ☐ | Test deposits/withdrawals, network compatibility (ERC-20, BEP-20, etc.), sandbox checks. |

Final Words

CoinDCX is India’s largest cryptocurrency exchange with over 20 million users, strict compliance, and a transparent Proof of Reserves policy. Listing on it requires serious preparation: disclosure of tokenomics, smart contract audit, legal opinion, KYC team, and readiness for FIU-IND/PMLA requirements. An important factor remains the 1% TDS tax on each transaction, which reduces trading activity and requires a well-thought-out strategy to incentivize traders. The project also needs to consider market making in INR pairs in advance, where order book depth and narrow spreads are critical. PR mistakes or insufficient documentation can delay the launch and damage the reputation. To reduce risks and increase the chances of a successful listing, teams often turn to services such as Listing.Help, which accompany the project from application to launch.

How Listing.Help Can Assist

Listing.help helps projects not only get listed, but also develop the right strategy for going public. The service handles negotiations with the exchange and explains all the nuances of internal procedures, saving the team time. Experts advise on how to build communication with the local community and adapt marketing to the Indian market. Particular attention is paid to managing investor expectations and minimizing reputational risks before and after the start of trading. Listing.Help also helps establish interaction with market makers to maintain stable liquidity at the start. A separate area of work is analytics: monitoring key metrics and recommendations for operational adjustments. As a result, the project receives not just a listing, but comprehensive support that increases confidence in the token and reduces operational risks.

February 23, 2026

February 23, 2026