How to List Token or Coin on HTX

September 10, 2025

September 10, 2025 Updated: September 11 2025, 10:47

Updated: September 11 2025, 10:47

LEAVE A REQUEST

Launching your own token project? Our experts are ready to help with listing on exchanges, market making, marketing and other solutions

SUBMIT APPLICATIONHTX (formerly Huobi) is one of the oldest CEX crypto exchanges, ranked in the top 10 exchanges according to CoinMarketCap. It has a weekly audience of more than 5 million people and generates a daily trading volume of $4 billion.

Today, we will provide practical instructions on how to apply for a coin listing on HTX. The guide will be helpful for both Web3 teams and project managers. We will look at the listing options available, the selection criteria the platform applies to projects, how to prepare for the application process, and how to avoid common mistakes. Let’s get started!

What Is HTX and Why List There?

The HTX exchange was launched in China in 2013. It is now one of the leading exchanges in the Asian and global markets. It has record trading volumes and a vast user base of 47 million people. A large number of tokens are traded on the exchange. The number of available trading pairs is close to 1000.

HTX has strict selection standards for new tokens, but at the same time, it can provide significant marketing support for listings.

Listing options on HTX

There are currently two listing options available on HTX: direct spot listing and Launchpad/Launchpool.

Direct spot listing is suitable for most projects. With this option, the project team fills out a listing application and provides all the necessary documents. During the due diligence stage, the exchange reviews the documents provided for transparency and compliance with all requirements.

The ecosystem campaigns are suitable for projects seeking rapid growth and increased reach. The project is placed on Launchpad/Launchpool, allowing it to attract additional investor attention and increase the coin’s visibility.

HTX selection criteria: what the exchange checks

When reviewing a project, the HTX team will check the following details:

- Company legal documents. Transparency and legal status in your jurisdiction. Compliance with all established KYC and AML requirements.

- Tokenomics. The team will check the transparency of tokenomics, the presence of vesting, and the fairness of coin distribution.

- The project must have passed a smart contract audit for listing. It must be performed by one of the reputable and recognized auditing companies.

- It is essential to show the existence of a product or MVP. The exchange needs to see that you are developing a product and can show a working version of it.

- Marketing plan for promoting the project. It should include specific events and stages both before and after listing. The more detailed it is, the better. The exchange needs to understand that after listing, you will continue to develop the project and work on growing the community.

- The team will review and approve the initial liquidity plan for listing. It should include the work of a market maker.

- The exchange will check the team’s previous experience and reputation. Information about the team must be open. This makes the project more trustworthy for both the exchange and investors.

Preparing for token listing

Now that you understand what the exchange will check, you need to prepare a package of documents to send along with your application.

| Document | Why it is needed | What is checked during verification |

| Whitepaper | A detailed description of the project’s goals, concept, roadmap, and technical nuances. | The information must be complete and clear. After reading the whitepaper, the reader should not have any additional questions. |

| Tokenomics | Provides complete information about the token and its utility, including the number of coins in circulation, unlocking, and vesting schedule. | The exchange team evaluates the realism and transparency of the tokenomics. All details about the token must be disclosed. |

| Smart contract and information about its audit | Provides an understanding of the smart contract code’s contents and its security. | The exchange team most often looks at the audit company’s report. |

| Legal documents | Help confirm the legality of the project. | Check whether the information complies with regulatory requirements. |

| Audience activity and size | How active and engaged the project’s audience is | The exchange team checks that the data has not been inflated. It studies the activity of the community on the project’s official social networks. |

| Liquidity plan | Necessary to understand how the project will maintain the liquidity of the token after listing. | The team looks at the realism of the plan and the presence of a market maker. |

| Project promotion plan | Provides an idea of how the project will promote the token before and after listing. | The team looks at the budget and specific actions described in the plan. |

| Team contacts | Understanding who on the team is responsible for listing. | They look at the competence of the selected employee.It’s better to provide the CEO’s contact details. |

Step-by-step instructions for submitting an application

Once you have gathered all the necessary documents, you can proceed with submitting your application. First, ensure you have all the required elements in place: collected documents, a completed audit, a clear marketing plan with specific actions, and sufficiently transparent tokenomics.

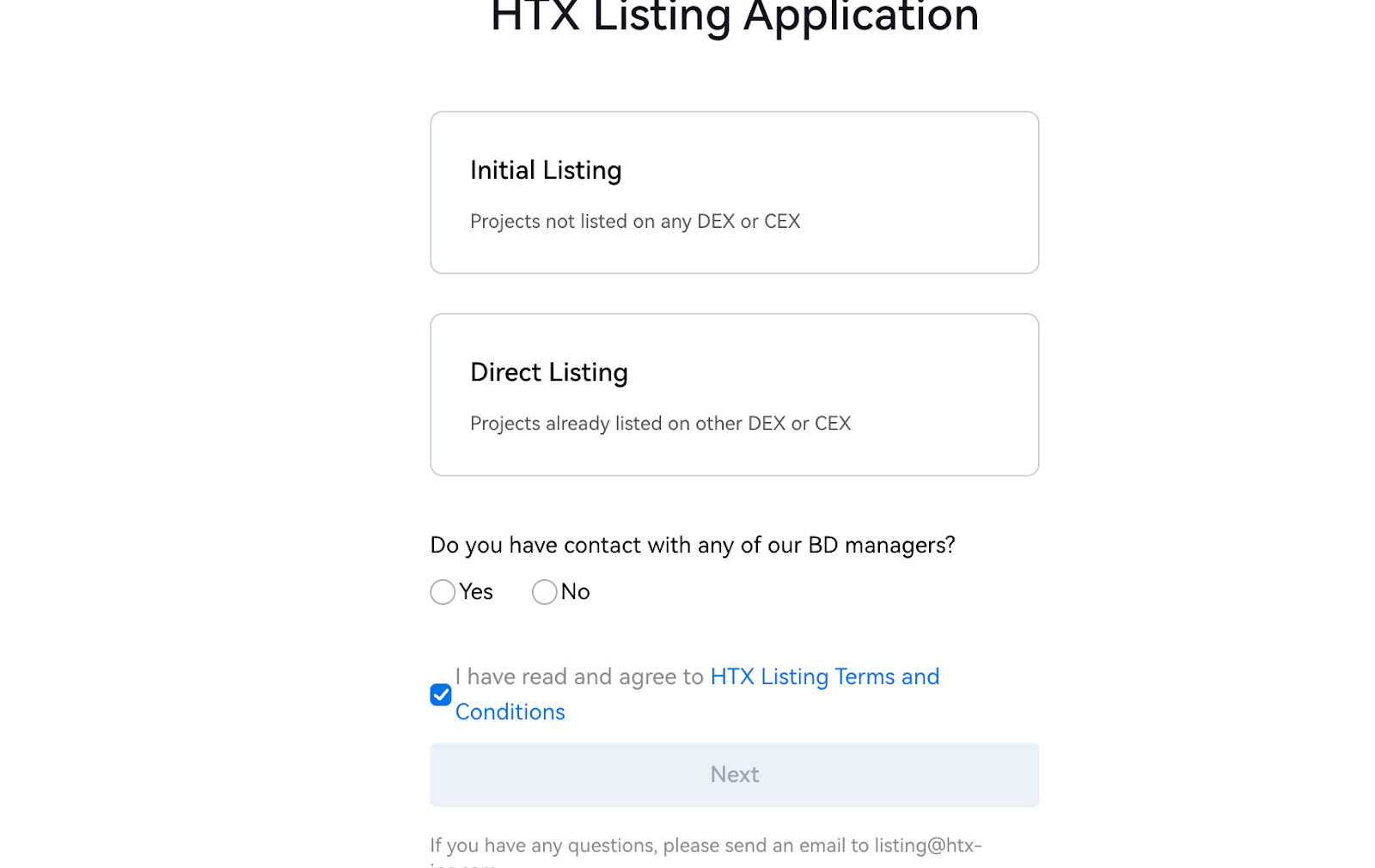

Once you have gathered the documents, you can go to the official HTX listing form and start filling it out.

In the form, you will need to fill in basic information about the project, specify whether the token is traded anywhere else, or if this will be its first listing. It is essential to fill out the application as thoroughly and clearly as possible so that the HTX team does not have any questions, as additional questions significantly increase the listing time.

After the application has been reviewed and approved, the exchange’s technical team will take over and perform the technical integration of the new token on HTX. They will check the smart contract and the functionality of the token deposit and withdrawal.

Once the technical integration of the token is complete, the exchange will publish a listing announcement and begin providing marketing support. This may include AMA sessions, trading activities, and other events that increase activity around the upcoming listing.

On the agreed date and time, trading will start, and the token will become available for trading to all HTX users.

Common mistakes and how to avoid them

Many teams facing token listing for the first time make the same mistakes. Knowing about them, you can better prepare for the upcoming listing. The HTX exchange most often denies projects that:

- Do not have a smart contract audit.

- Have opaque tokenomics. For example, the vesting schedule may not be clearly stated.

- The package of documents is not sufficiently detailed. The whitepaper does not answer all user questions, and the legal documents raise doubts.

- Lack of a marketing plan or liquidity plan.

- Template answers to the exchange’s questions based on the results of the review.

If you lack experience in listing and are concerned that mistakes may lead to your listing application being rejected, we recommend contacting Listing.Help. This is a listing agency that helps with all stages of listing. We offer a comprehensive turnkey service, allowing you to select a suitable exchange, prepare for exchange listing requirements, develop a marketing plan, build a liquidity plan, provide market-making services, and more. We have direct contacts with HTX and other exchanges, which reduces the listing time by an average of 5 times compared to independent applications. If you have any questions, you can always contact us for a free consultation and get answers to all your questions, as well as an assessment of your chances of a successful listing on HTX.

Conclusion

Listing on the HTX exchange allows the project to significantly expand its audience and make itself known to the whole world. If you attract the attention of traders and investors, this can dramatically boost your project’s audience. However, the exchange rejects applications from projects that are poorly prepared for submission, so special attention should be paid to the preparatory stage.

If you feel you need help, you can always contact Listing.Help. We will take care of the listing at any stage. Order a free consultation and get answers to your questions right now!

February 23, 2026

February 23, 2026