How to List Token or Coin on Indodax

September 29, 2025

September 29, 2025 Updated: September 30 2025, 10:54

Updated: September 30 2025, 10:54

LEAVE A REQUEST

Launching your own token project? Our experts are ready to help with listing on exchanges, market making, marketing and other solutions

SUBMIT APPLICATIONIn this article, we will discuss the process of listing a token on one of Indonesia’s largest cryptocurrency exchanges, Indodax. The exchange has over 7.5 million users and specializes in pairs with the Indonesian rupiah (IDR), making it an important tool for entering the Southeast Asian market. We will take a detailed look at the key requirements for projects, how to go through the compliance process, prepare the necessary documents, and create an effective liquidity strategy. We will also discuss the importance of localizing content for the Indonesian audience and the steps you need to take to get exchange approval and attract the attention of the local community.

About Indodax

Indodax is the largest cryptocurrency exchange in Indonesia and one of the leading players in Southeast Asia. Since its launch, it has become the main channel for millions of local retail investors seeking easy access to digital assets. The exchange pays special attention to trading pairs with the Indonesian rupiah, which makes it unique and extremely popular among users.

Listing on Indodax gives projects direct access to fiat liquidity in the national currency. At the same time, entering the Indonesian market requires adaptation to local regulations, high compliance standards, and specific user habits. Successful projects are those that are prepared not only technically but also strategically, taking into account the characteristics of a rapidly growing retail audience.

Indonesia Compliance Primer

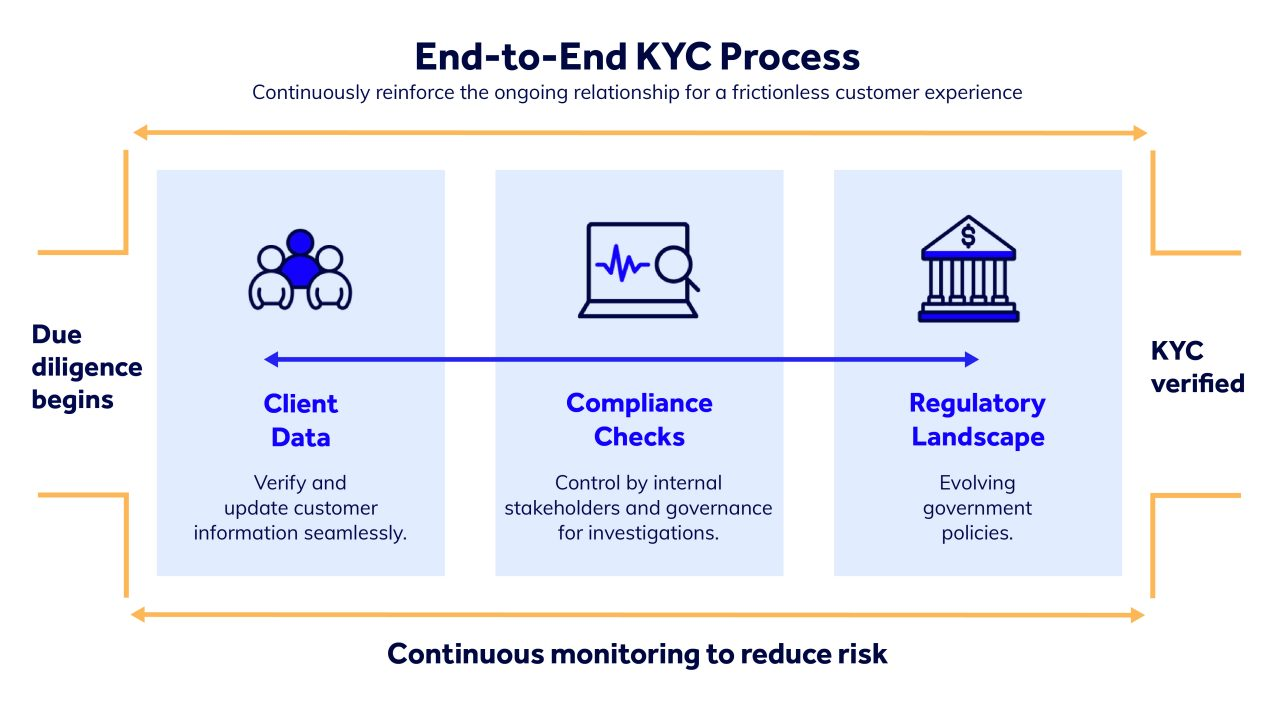

The cryptocurrency market in Indonesia is controlled by several government agencies. The main roles are played by the Bappebti agency, which oversees the trading of digital assets as commodities, and the OJK financial regulator, which is responsible for compliance with regulations in the financial sector. All projects are subject to KYC and AML procedures, which include:

- verification of the identity of key team members

- control of the origin of funds

- transparency of tokenomics and financial flows

The exchange expects projects to be able to confirm the legality of the token and provide complete data on the ownership structure and distribution of assets.

To speed up the verification process, it is helpful for projects to consult with lawyers who specialize in Indonesian law. Local expertise helps to correctly prepare documents, adapt the whitepaper and answers in the application, and avoid formal inconsistencies. This step increases trust and allows projects to pass Indodax compliance much faster.

IDR Rails and Order Books

Trading in pairs with the Indonesian rupiah is a key feature of Indodax. For users, this is the main way to enter the crypto market without having to deal with foreign currencies. Projects here are expected to pay special attention to order book depth and exchange rate stability, as sharp fluctuations can undermine the confidence of retail investors. Maintaining stability requires a well-thought-out market-making strategy and liquidity distribution.

The performance of INR pairs is directly influenced by local banking mechanics. On-ramp and off-ramp systems for the rupiah depend on the operating schedules of payment networks, which is important to consider when planning a launch. Projects should prepare in advance:

- a liquidity reserve for periods of high activity

- a plan to support the spread during peak hours

- monitoring of bank gateways for timely response

Such preparation allows you to avoid technical failures and provide users with a reliable experience from the very beginning of trading.

What to Prepare Before Applying

Before submitting an application to Indodax, the project must compile a complete set of documents and materials. The exchange checks the technical aspects, legal basis, business indicators, and readiness to work with the local audience. Deficiencies in the documents or poor preparation can seriously slow down the process. What you should pay particular attention to:

- Whitepaper: project description, roadmap, and key idea

- Pitch deck: brief presentation for the exchange and investors

- Tokenomics: disclosures indicating the circulating volume and unlock schedule

- Smart contract: token code and independent audit report

- Legal package: founding documents, KYC confirmation, and ownership structure

- Team and metrics: team data, active users, partnerships, product metrics

- Marketing and community: readiness for localization of materials, PR strategy, community development plans

A project that provides the entire package in this form demonstrates the seriousness of its intentions and increases its chances of getting listed faster and without additional delays.

How to List on Indodax — Step by Step

The process of listing on Indodax usually goes through several consecutive stages.

- Step 1.Initial contact: The project applies via the official form or through direct contact with the listing team. At this stage, it is important to provide basic information about the token and the company.

- Step 2.Application submission: The team fills out the application with a complete set of documents, including a white paper, tokenomics, legal documents, and a smart contract audit.

- Step 3.Due diligence: The exchange conducts a comprehensive review. They ask clarifying questions about the origin of funds, liquidity, market makers, business models, and metrics.

- Step 4.Technical integration: The token is connected to the Indodax infrastructure. Wallet compatibility is checked, the smart contract is validated and test deposits and withdrawals are carried out.

- Step 5.Trading pair approval: The exchange and the project jointly determine the trading pairs, usually with IDR, as well as the launch schedule.

- Step 6. Listing announcement: An official announcement is published. A deposit window is set, then trading begins, and finally, withdrawals are opened.

Liquidity Strategy for IDR Pairs

For a successful launch on Indodax, the project needs to determine the key trading pairs in advance. Priority is usually given to IDR, and bridge pairs via USDT are used as an additional tool for user convenience.

Particular attention is paid to the depth of the order book and the stability of quotes. The exchange and retail traders expect the order book to have a sufficient volume of orders, at least equivalent to $25,000–50,000, and the spread should not exceed 0.5–1 percent. This helps minimize slippage and ensures confidence in trading in the national currency.

To maintain these parameters, it is necessary to constantly monitor market quality and work with market makers. Activity should be planned taking into account local peaks, which occur during the daytime. This approach allows you to control liquidity and maintain the interest of retail investors in the first weeks after launch.

Marketing and Localization

A successful launch on Indodax is impossible without adapting marketing to the Indonesian audience. First and foremost, the project should translate its website, white paper, and announcements into Bahasa Indonesia, as users value the availability of information in their native language. The next step is to work with the local community. This includes launching Telegram and Instagram channels, conducting AMAs with local influencers, and publishing in Indonesian media. The timing of posts also plays a role: the highest activity is observed during the daytime hours in Jakarta. It is also important to prepare an FAQ section and a knowledge base to support users at the start. Having clear answers to basic questions reduces the burden on the team and helps to build trust in the token more quickly.

Costs and Timelines

The timing and budgets for listing on Indodax can vary significantly depending on a number of factors. The speed of the process is influenced by aspects such as the completeness of the documentation package, the readiness of the project, and the accuracy of all data. The more prepared the project is, the faster it goes through all the stages. The following often speed up the process:

- pre-prepared legal documents

- the availability of an independent audit of the smart contract

- clearly defined tokenomics and vesting schedule

- the availability of localized materials and a marketing strategy

The process may be delayed if:

- the documents are not agreed upon or contain inaccuracies

- the project is not ready for compliance or requires further work on the smart contract

- there are delays in preparing marketing or localization

For effective planning, it is necessary to build in buffers for time and expenses. It is worth allowing for additional weeks to respond to exchange requests and make audit revisions. In terms of expenses, it is important to have a reserve for legal expertise, localization, and additional checks that may arise during the process. This will help avoid surprises and speed up the listing process.

Common Issues and How to Avoid Them

Insufficient disclosure on tokenomics and auditing. Projects often fail to disclose details about tokenomics or conduct smart contract audits, which can delay listing. Prepare a complete description of tokenomics and ensure independent auditing in advance.

Suboptimal liquidity in IDR pairs. Without sufficient liquidity in IDR pairs, a project may face a sharp spread and low activity. Plan a market-making strategy and engage with market makers at the start.

Compliance issues. Problems with legal documentation can delay the process. Ensure that all documents and data comply with KYC/AML requirements and local laws.

Communication issues regarding timings and announcements. Errors in the announcement schedule or inconsistencies in timelines can cause confusion. Coordinate all key dates with the exchange and take into account the Indonesian time zone.

Here are some tips on how to avoid these mistakes:

- Prepare all documents in advance and check that they comply with standards.

- Ensure liquidity and maintain active communication with the exchange and market makers.

- Plan announcements taking into account local peak times.

Risks and Red Flags

As with all processes, there are risks involved. Here are some important things to keep in mind:

Regulatory changes. Rapidly changing legislation may affect the ability to continue working with Indodax. It is important to monitor changes in regulations and quickly adapt the project to new requirements.

Fiat Rail Interruptions. Problems with payment gateways or delays in withdrawals can reduce liquidity and cause user dissatisfaction. Regular monitoring and interaction with payment systems will help avoid such problems.

Risks of non-compliance with network standards and tags/memos for deposits. Errors in setting up deposit addresses or mismatched tags and memos can lead to loss of funds and delays. It is important to check all settings in advance and provide the correct data to the exchange.

Reputational incidents. Scandals or security breaches can negatively affect the project’s reputation and impact its listing. Transparency in the event of incidents and quick measures to resolve issues will help minimize the consequences.

Indodax Listing Checklist

We have prepared a handy checklist, with step-by-step instructions on how to prepare your project for listing on Indodax (you can make a screenshot of it and print).

| Item | Owner | Status | Notes |

| KYC Team | Project Team | ☐ | Verify all team members’ identities. |

| Legal Documents and Legal Opinions | Legal Department | ☐ | Prepare company registration and legal opinion. |

| Smart Contract and Audit | Development Team | ☐ | Ensure smart contracts are audited by a third-party. |

| Public Tokenomics and Unlock Disclosures | Marketing & PR Team | ☐ | Provide full tokenomics and unlock schedule. |

| Integration Contacts | Technical Team | ☐ | Ensure clear communication with technical support. |

| Test Transactions | Development Team | ☐ | Run test deposits and withdrawals. |

| Marketing Plan with KPIs | Marketing Team | ☐ | Prepare a detailed marketing plan with clear KPIs. |

| Liquidity Budget for IDR | Finance Team | ☐ | Budget required for liquidity provisioning for IDR pairs. |

| Announcement and Embargo Plan | Marketing Team | ☐ | Plan for announcements and embargo protocols. |

| Support and Incident Response Protocol | Support Team | ☐ | Prepare support protocols and incident response plan. |

| Monitoring Dashboard | Monitoring Team | ☐ | Set up a live monitoring dashboard for performance. |

| Post-Listing Disclosure Process | Compliance & PR Team | ☐ | Define post-listing reporting process and transparency. |

Final Words

Listing a token on Indodax is not just about meeting technical requirements. Success in Indonesia depends on understanding the local market, adapting to regulatory standards, and delivering clear communication in Bahasa Indonesia. Projects that prepare thoroughly, maintain transparency in tokenomics and compliance, and build trust with retail investors are the ones that gain the most from entering this rapidly growing market. Indodax provides access to fiat liquidity in IDR, but only well-prepared teams can truly capitalize on this opportunity.

How Listing.Help Can Assist

Listing.Help is a service dedicated to guiding crypto projects through exchange listings, helping teams avoid unnecessary risks and delays. The specialists provide full support at every stage of the process and ensure the project is presented in the best possible way.

Project readiness audit: the team reviews tokenomics, the smart contract, legal documentation, and team KYC to spot potential weaknesses.

Document preparation: all materials are organized into a complete and consistent package, including presentations and supporting files, with careful alignment to publicly available information.

Liquidity and marketing strategy: detailed KPIs are defined for trading pairs, a market-making plan is prepared, and marketing activities are tailored to the target audience of the exchange.

Post-listing assistance: once trading begins, the team tracks early performance, analyzes key metrics, and provides recommendations to strengthen market presence and community engagement.

February 23, 2026

February 23, 2026