Hyperliquid Listing Fee 2026 — Is There a Fee to List a Token?

October 30, 2025

October 30, 2025 Updated: January 4 2026, 09:45

Updated: January 4 2026, 09:45

LEAVE A REQUEST

Launching your own token project? Our experts are ready to help with listing on exchanges, market making, marketing and other solutions

SUBMIT APPLICATIONThere is no platform “listing fee” on Hyperliquid. Spot deployments are permissionless: builders acquire a ticker via a Dutch auction. Depending on demand, winning the auction can require a significant budget. Additionally, you will need to deploy an HIP-1 token and open a market with an on-chain order book (CLOB).

Your real spend goes into liquidity depth, security/audits, routing/integrations, and marketing. Below is a pragmatic breakdown for 2026 and a short technical overview so search engines clearly see why Hyperliquid is different from AMM DEXs.

For a full breakdown of total launch costs and a step‑by‑step process, read the complete guide: https://listing.help/hyperliquid-listing-cost/

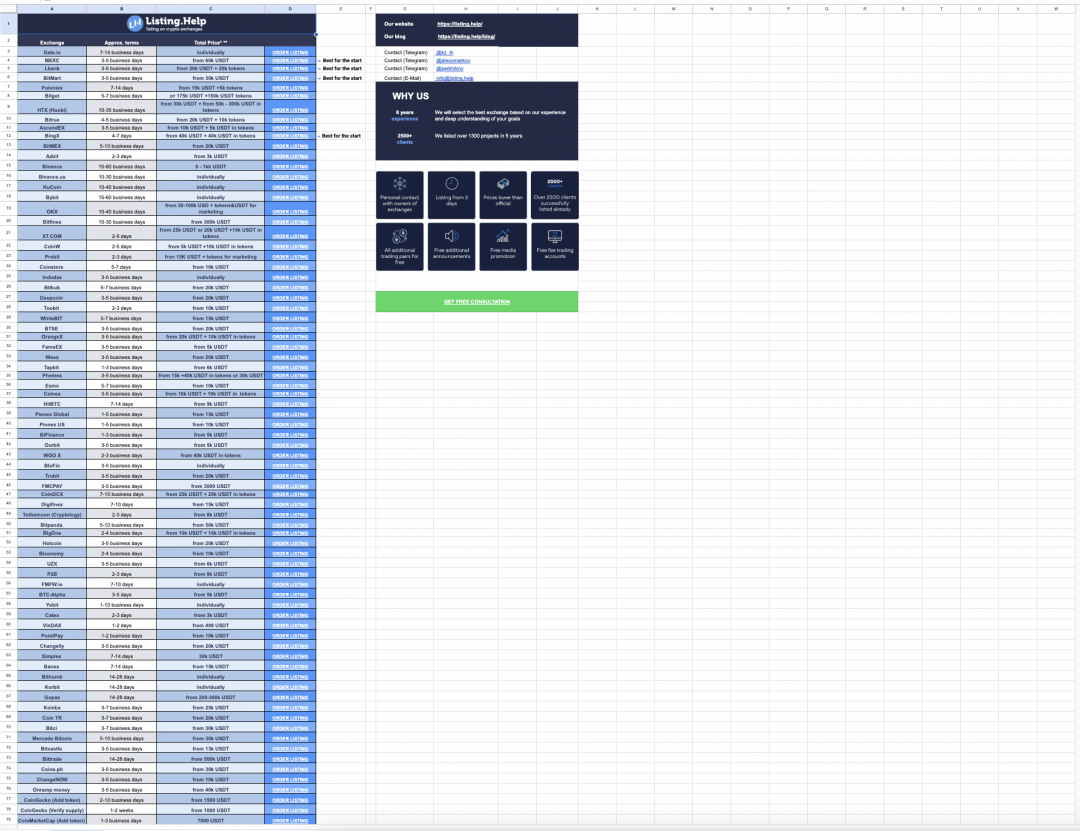

Where the Budget Actually Goes (2026)

| Bucket | Typical Range | Purpose | Notes |

| Dutch auction | $100K–$300K+ | Acquiring a ticker | Be ready for competitors with a higher budget |

| Liquidity | $15K–$80K+ | Seed depth for main pair (often USDC/Token) | Back‑solve from target slippage (<1–2%) at trade size |

| Audits & Security | $10K–$60K | Independent review, monitoring, governance controls | Verify code, document privileges, timelocks/multisig |

| Integrations & Routing | $5K–$25K | Metadata, explorer links, trackers/aggregators | Prevent impersonation; publish canonical market links |

| Marketing & Brand | $5K–$30K | Docs/website, announcements, PR/KOLs | Sequence with go‑live and depth milestones |

Technical Overview (Why Hyperliquid ≠ AMM)

• On‑chain CLOB with price‑time priority (tick/lot sizes), not x*y=k pools.

• Custom L1 and consensus optimized for trading; sub‑second finality.

• HIP‑1 token standard for spot assets; permissionless deployments.

• Dutch auction to acquire the ticker before market creation.

• Hyperliquidity: single‑sided liquidity module to bootstrap depth.

Mini‑Checklist for Submissions

1) Publish independent audits and remediation; verify source; document privileges.

2) Define primary market (USDC/Token), tick/lot, and depth goals; align MM policies.

3) Prepare metadata (logo, links) and canonical market address; push to trackers.

4) Plan marketing around liquidity milestones; monitor slippage/spreads and expand pairs.

February 23, 2026

February 23, 2026