Uniswap Listing Cost — How Much Does It Cost to List a Token in 2026?

October 19, 2025

October 19, 2025 Updated: January 4 2026, 10:05

Updated: January 4 2026, 10:05

LEAVE A REQUEST

Launching your own token project? Our experts are ready to help with listing on exchanges, market making, marketing and other solutions

SUBMIT APPLICATIONUniswap is a permissionless DEX: there is no exchange-controlled listing desk and no exchange-side fee. Any ERC‑20 can be listed by creating a liquidity pool. That makes Uniswap the fastest way to achieve tradability, but success still depends on security, liquidity, and communications.

This guide explains the real costs of “listing” on Uniswap in 2026, how to set up pools correctly, what budget items matter (liquidity, audits, marketing), and how to avoid common pitfalls like unsafe taxes or poorly configured pools.

What Is the Uniswap Listing Cost in 2026?

Exchange fee: $0. Uniswap does not charge a listing fee. However, teams should plan a realistic launch budget across three buckets: liquidity, security, and marketing.

Typical ranges we see:

– Liquidity & market‑making: $20K–$250K+ depending on the target pairs (e.g., ETH/Token, USDC/Token), initial depth, and volatility.

– Security & compliance: $10K–$80K for audits, tooling (monitoring/bots), and legal review of token design where applicable.

– Marketing & awareness: $10K–$150K for PR, KOLs, community, listings on trackers, and partner integrations.

Gas cost to deploy or create a pool is relatively small compared to the above. The real driver of user experience on DEX is liquidity depth (slippage, spreads) and security signals (audits, verified contract, renounced privileges or timelocks).

Key Factors That Influence Uniswap Launch Budgets

Plan with these drivers in mind:

– Target pairs and depth: ETH vs. stablecoin pairs; minimum depth to keep slippage <1–2% at target trade size.

– Volatility and MM strategy: volatility bands, rebalancing, anti‑sandwich guardrails.

– Contract safety: audits, no backdoors, transparent tax/ownership, revoke dangerous permissions where possible.

– Community traction: real users, DeFi integrations, partner wallets/bridges.

– Indexing & discovery: token lists, DEX aggregators, CMC/CG tracking eligibility.

Uniswap‑Specific Nuances: Pools, Fees, and Token Lists

On Uniswap v3, you choose a fee tier (0.05%, 0.3%, 1% are common) and provide liquidity across price ranges. For new tokens, the 0.3% tier on an ETH or USDC pair is a typical starting point; you can add depth later or open additional pairs.

Improve discoverability by submitting to reputable token lists used by wallets, and by registering metadata (logo, links). Coordinate with DEX aggregators to ensure routing is optimal at launch.

Uniswap Listing Requirements (2026 Checklist)

Before launch, make sure you cover:

✅ Verified ERC‑20 contract (Etherscan verification) with clear, documented privileges.

✅ Independent audit(s) covering transfers, taxes, ownership, and upgradeability.

✅ Transparent tokenomics: supply, vesting, unlocks, and emissions where applicable.

✅ Liquidity plan per pair (initial depth, expansion milestones, MM partner).

✅ Operational runbook: monitoring, multisig controls, timelocks, incident response.

✅ Discovery: token lists, aggregator coverage, CMC/CG submission readiness.

How to “List” on Uniswap — Step‑by‑Step

A practical launch sequence:

1) Finalize and verify the ERC‑20 contract; document all privileged roles and taxes.

2) Complete an independent audit and remediate findings; publish the report.

3) Decide primary pair(s) (e.g., ETH/Token, USDC/Token) and fee tier(s).

4) Create the pool and seed initial liquidity; align depth with target trade size and slippage goals. To ensure a higher quality launch, consider engaging an experienced launch partner such as Listing.Help to ensure a higher quality and faster launch.

5) Register on token lists; coordinate with aggregators and wallets; publish accurate metadata.

6) Announce the pool address (not just the token) and educate users on the correct trading link.

7) Monitor KPIs (depth, slippage, price impact); expand liquidity and pairs as demand scales.

The detailed process for listing your token on Uniswap is described in our other article.

CEX vs. Uniswap — Price and Fit

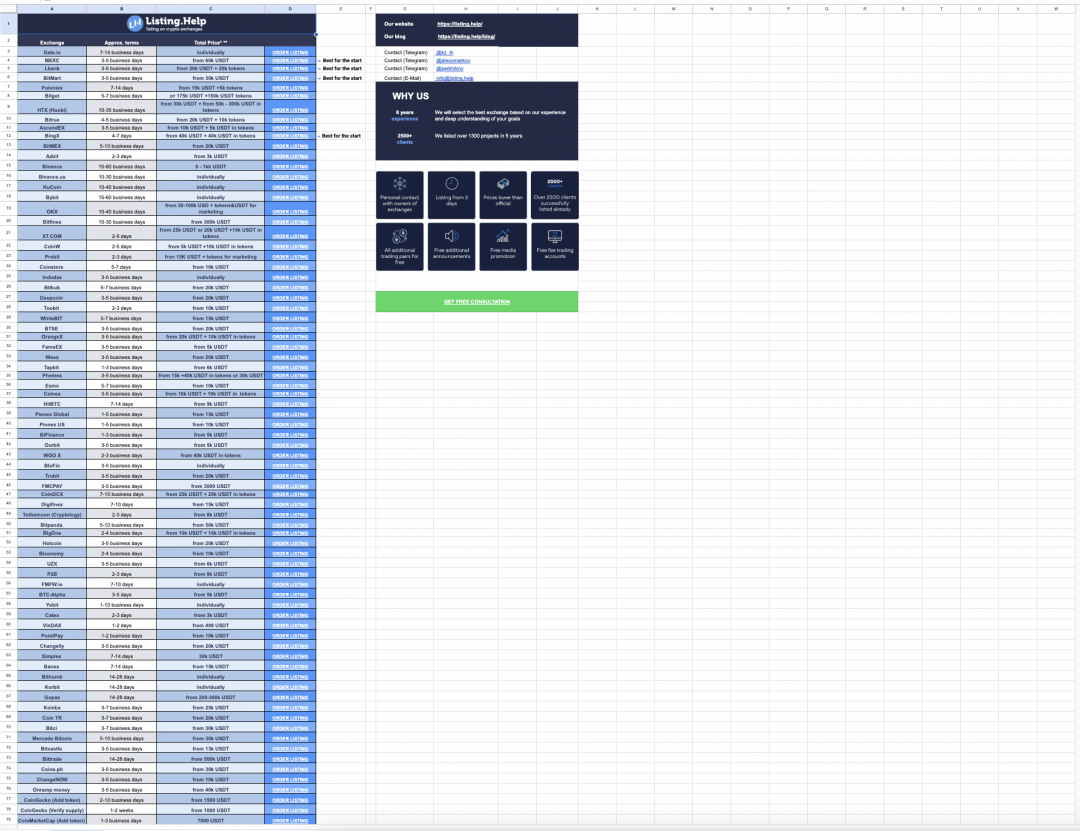

How a DEX launch compares to CEX listings:

| Venue | Listing Fee | Notes |

| Uniswap (DEX) | $0-$200K | Permissionless; budgets shift to liquidity, security, and awareness |

| Mid‑tier CEX | $20K – $120K | Fee + liquidity + marketing; faster retail reach |

| Top‑tier CEX | $100K – $250K+ | Fee + large liquidity + compliance burden |

Timeline and Practical Tips

– Prep (1–2 weeks): audits finalized, token lists ready, routing checks.

– T‑0: pool creation and liquidity seeding, announcements, aggregator sync.

– Post‑launch (1–4 weeks): expand depth, add pairs, monitor KPIs and security.

Tip: always publish the pool address and verify links to prevent phishing.

With an agency like Listing.Help, you can get listed on an exchange faster.

January 28, 2026

January 28, 2026