How to Launch a Legal Compliant ICO in Singapore

December 2, 2024

December 2, 2024 Updated: July 16 2025, 01:21

Updated: July 16 2025, 01:21

LEAVE A REQUEST

Launching your own token project? Our experts are ready to help with listing on exchanges, market making, marketing and other solutions

SUBMIT APPLICATIONSingapore is recognised as a global fintech hub. Companies in its jurisdiction can launch ICOs to raise capital, and the country itself offers a stable regulatory framework and support for fledgling blockchain-related projects.

However, when it comes to launching an ICO, projects face a number of challenges. First and foremost, there is the need to comply with Singapore’s legislation. The main regulator is the Monetary Authority of Singapore (MAS), which sets the rules for projects involved in cryptocurrency transactions.

In today’s article, we will tell you how to properly prepare for launching your ICO in Singapore to ensure that the whole process is legal, as well as highlighting the specific steps you need to take to comply with MAS requirements.

What is an ICO and Why is it Important?

Initial Coin Offering (ICO) is one way to raise capital. A project issues its own token, which is sold to interested investors. In most cases, tokens do not give their owner the right to own part of the company, as is the case with shares on the traditional financial market. However, tokens can be used on the platform to earn extra income, pay commissions or while using the project’s product. As a result, more and more crypto startups are opting for ICOs due to their accessibility and global reach.

Advantages of ICO for Businesses

The main advantages of an ICO are:

- Ease of raising capital. Projects avoid the need to borrow from a bank or raise venture capital.

- Unlike a stock market listing, a crypto listing implies a global reach and access to international investors from most countries in the world. This makes an ICO an ideal tool for companies looking to reach the international market.

- An ICO takes a relatively short amount of time to complete. This allows a project to raise money faster and finish developing its product.

- ICOs bring more attention to blockchain technology, which develops the industry and brings new ideas to the market.

Regulatory Landscape for ICOs in Singapore

Singapore is considered a country with a favourable environment for crypto startups. However, projects must comply with strict regulations to avoid fines.

Role of MAS (Monetary Authority of Singapore)

The Monetary Authority of Singapore (MAS) in Singapore is the central bank and regulator of the entire financial environment. And ICO is part of financial transactions, so it falls under the supervision of the MAS. To better understand what the MAS does in Singapore, let us describe its main functions:

- MAS aims to prevent financial fraud and ensure that companies provide only honest and transparent information about their activities.

- MAS protects investors and ensures that before investing in a project, investors are provided with a full range of information to assist them in making investment decisions.

- Under MAS, all projects must comply with know-your-customer (KYC) and anti-money laundering (AML) requirements.

- ICOs that qualify as securities must comply with the Securities and Futures Act (SFA).

Token Classification

MAS classifies tokens into 3 main categories, each with its own legal nuances.

- Securities tokens are tokens that give investors rights similar to traditional securities. Projects with such tokens are required to register under the Securities and Futures Act (SFA) and provide the necessary launch information.

- Utility tokens are most commonly understood as tokens used to access a project’s services or products. They are no longer regulated as strictly as securities, but companies with utility tokens must comply with consumer protection laws.

- The final category includes payment tokens. These are used as a medium of exchange for a good or service and are regulated under the Payment Services Act. Tokens in this category require the necessary licences.

It is important to understand how your token will be categorised as this will determine the ICO requirements for your project. Mistakes in categorising your token can lead to fines and even a complete ban from operating in Singapore.

Legal Requirements for Launching an ICO

To legally launch an ICO in Singapore, you must comply with legal requirements designed to ensure investor protection and compliance with local laws. Below, we look at the key requirements you need to comply with to successfully launch an ICO.

Compliance with Securities Laws

Before launching an ICO, you need to determine whether your token falls under the Securities and Futures Act (SFA).

- If your token gives investors the right to receive income or a stake in the project, such a token is considered a security.

- If the project is dependent on the actions of a team, this may also be considered a security token.

- If the token is only used to access goods or services, it is not covered by the SFA. Payment tokens are regulated under the Payment Services Act (PSA).

- If investors expect a token to increase in value, such coins may be classified as investment products.

Tokens that are classified as securities must meet a number of requirements:

- Register with MAS and provide them with full information about the project, including its description, project objectives and risks to investors.

- Provide clear and transparent documentation detailing the project’s tokenomics, roadmap and technology description so that investors are fully informed to make investment decisions.

- Your token must meet all MAS criteria for tokenised securities.

KYC and AML Procedures

To prevent illegal transactions and money laundering, projects must comply with KYC and AML regulations. This includes

- Verifying the identity of investors participating in the ICO: their passport details and home address;

- All transactions made are recorded and verified to ensure compliance.

- Your project team is aware of and complies with KYC and AML legislation.

In order to avoid fines or suspension of the project, it is necessary to notify the MAS in a timely manner in accordance with the applicable regulations.

Step-by-Step Guide to Launching an ICO

To launch an ICO in Singapore, you can use the detailed guide below.

Define Your Project’s Concept

Define a clear goal for your ICO, its unique idea and the potential audience that would be interested in the project.

Token Development

Determine how your token will be categorised: security, payment or utility, and then create a smart contract for the future token. It will be a plus if the smart contract code is verified by one of the popular auditing companies.

Drafting a Whitepaper

Write a Whitepaper that includes a detailed description of the project, an explanation of the technical implementation, and an elaboration of tokenomics.

Running a Marketing Campaign

Use all possible platforms such as social networks, forums and blogs to launch a marketing campaign and draw maximum attention to your project and future ICO. Your marketing campaign can include contests, influencer collaborations, ama-sessions and other activities that will increase the visibility of your project.

Launching the Platform and Token Sale

Make sure you meet all legal requirements, then go through the TGE token generation process and start bidding.

Common Mistakes to Avoid

Non-compliance with Token Regulations

A common mistake is to misclassify your token. It can lead to large fines and serious legal consequences.

Ignoring KYC/AML Procedures

Violating or ignoring KYC and AML procedures can damage your reputation and lead to fines.

Lack of a Solid Marketing Strategy

Before launching an ICO, it is important to develop a marketing strategy and allocate the necessary budget. This will help investors and regulators better understand the prospects of your project and the seriousness of your intentions.

Benefits of Launching an ICO in Singapore

Launching an ICO in Singapore has several undeniable advantages. First and foremost is the stable regulatory environment, which includes clear and transparent rules for crypto startups. Another benefit could be the support for blockchain companies. Singapore regularly incentivises the development of the technology in its region. After all, the country is the largest financial centre in the world. Launching an ICO here will give you access to a large number of investors, making it easier to raise capital.

Conclusion

Launching a legal ICO in Singapore requires careful compliance with MAS requirements, from proper token classification to KYC and AML compliance. With proper planning, you can list your token in one of the most favourable jurisdictions in the world.

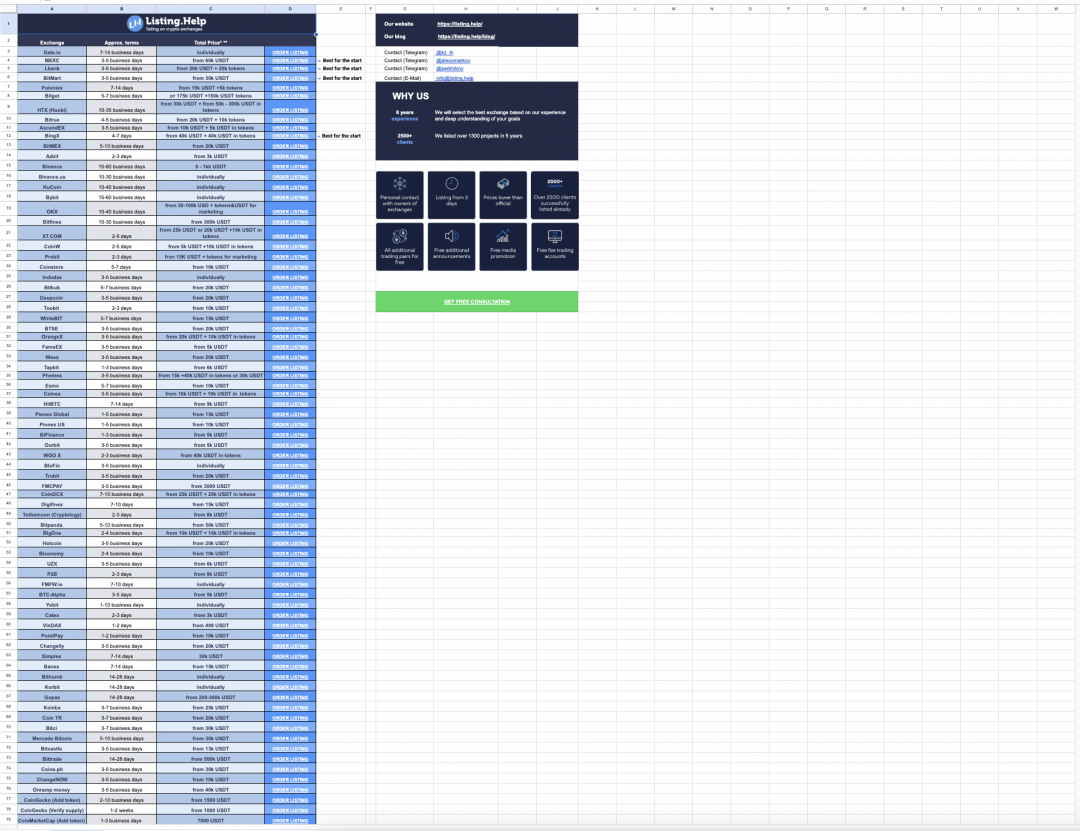

And if you need help listing your token, you can contact Listing.Help. We will help you to speed up the process of token listing by 5 times through direct communication with crypto exchanges, assistance with smart contract review, preparation of necessary documentation for listing, as well as positioning your project and developing its marketing strategy. Successful development of your project!

For more insights and updates on the crypto world, don’t forget to check out our blog at Listing.Help

February 23, 2026

February 23, 2026