What is Grid Trading? How do Grid Trading Bots work?

October 1, 2023

October 1, 2023 Updated: January 27 2025, 07:25

Updated: January 27 2025, 07:25

LEAVE A REQUEST

Launching your own token project? Our experts are ready to help with listing on exchanges, market making, marketing and other solutions

SUBMIT APPLICATIONCrypto prices shift rapidly, and since the market never sleeps, it’s a challenge for traders to stay on top of things. If you’re new to trading, it’s even harder to catch and capitalize on these fast-paced changes. Waiting too long to decide can also mean missing opportunities.

But don’t worry, there’s a solution: trading bots. These automated tools can handle trades for you, ensuring you never miss a chance to profit from price fluctuations.

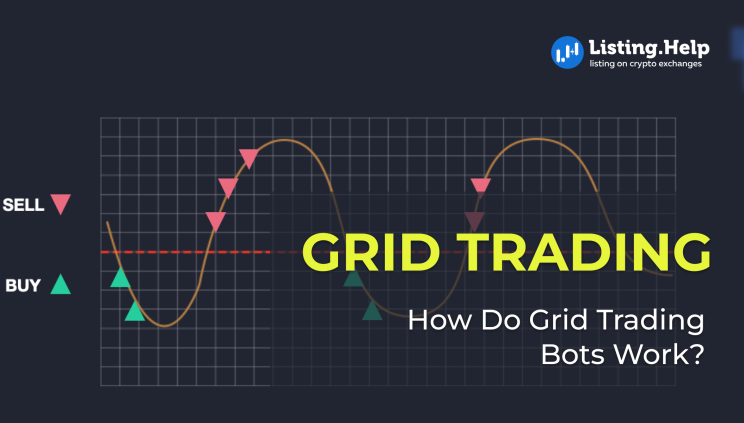

Crypto trading bots, when set up correctly, can trade on your behalf and help you profit. A popular method they use is the grid trading strategy. Here’s how it works: the bot sets up a “grid” of buy and sell orders at various price points. This way, no matter how the market moves, the bot is ready to make a move. It’s like setting up a net to catch opportunities. The grid approach is smart because it capitalizes on tiny price changes and works well in both rising and falling markets, minimizing human errors.

Grid Trading: The Basics Explained

Cryptocurrency prices are notorious for their rapid changes. Experienced traders typically use charts to navigate through their trading decisions, but it’s easy for them to lose pace with the relentless alterations in prices, letting potential gains slip through their fingers. Engaging in multiple exchanges simultaneously further entangles the situation, making consistent vigilance an arduous task.

Enter grid trading — a crucial strategy for those immersed in the crypto trading arena. This technique assists traders in executing buying and selling actions within a predetermined price bracket of their choosing. The foundational belief here is that asset prices will inevitably oscillate within a specified range. By strategically positioning orders at diverse price points within this boundary, traders stand to garner profits from price swings in either direction — ascending or descending. Essentially, grid trading crafts a framework, a ‘grid’, if you will. Within this structure, a bot designed for grid trading operates diligently, pinpointing lucrative moments to initiate buy or sell orders for the trader.

How do they work?

Think of grid bots as computer programs built for trading. Their job? Make some money from price changes within a set range. As a trader, you tell the bot the rules — like the price range it should work in. Then, the bot gets to work, always sticking to the simple idea of “buy when it’s cheap, sell when it’s expensive.”

You get to decide how the bot should operate. You can choose things like the size of the grid or how much to trade. One of the cool things about grid trading is that the bot can handle lots of trades without needing constant attention. Instead of stressing over every single trade, you let the bot manage your funds, track profits, and more.

Here’s a quick breakdown: Pick a price range and decide on the number of smaller ranges (or grids) you want within it. By breaking down the price range into these grids, there’s a good chance you’ll hit a profitable trade. More grids mean the bot trades more often.

When a buy order happens, a sell order is set up right after. The opposite is also true: if something is sold, it’s set to be bought next. If the price moves back and forth between two grids, a trade happens, but the profit is a bit less.

Ways to make good trades using grid strategies.

Various crypto exchanges have their own grid trading methods and come with built-in bots. There are also outside platforms that work with all these exchanges and have their own grid trading bots.

Now, let’s dive into these strategies:

1. Spot grid trading

Spot grid trading is all about making money from price ups and downs. How? By setting orders to buy when prices dip and to sell when they rise at certain steps. Want to try this on an exchange like KuCoin? Just log in, find the trading bots section, and pick the spot grid option to set up a bot. From there, it’s up to you: go with the default settings or tweak them to your liking. There’s even an advanced mode where you decide the start price, the end point, and the profit target.

Here’s how it goes: when you kick off grid trading, the system buys at the current price and lines up buy and sell orders at different price levels. This method shines, especially when prices are all over the place. Every time the price moves within your set range, the system jumps in with your pre-decided buy or sell orders. And remember, the more price levels (or grids) you have, the more trades you can make.

Oh, and if you’re thinking of Binance, they’re in on this too. Once logged in, hit ‘trade’, then ‘strategy trading’. Pick your trading pair, adjust the settings, and the bot takes it from there, doing its thing automatically.

2. Reverse grid trading

Ever heard of a bearish market? That’s when prices are generally going down. Now, reverse grid trading is built for such times. In simple words, this bot tries to make a profit when prices fall. Instead of buying first and selling later, it flips the process: sell now, buy back later, usually at a cheaper rate. This way, you can gather more coins as the prices dip.

Getting started with reverse grid trading? Here’s what you need to do:

· Pick a trading pair, then click on the ‘reverse grid’ option.

· Decide on the maximum and minimum price you’re comfortable with, decide how many price levels (or grids) you want, and pick the type of grid spacing.

· Then, decide how much you want to put into this trade.

Done? Click on “create” and let the bot handle the rest.

For a clearer picture, consider this:

You set the highest price at 1000 USDT and the lowest at 800 USDT. You pick 10 grids and invest 1 BTC in total. The bot then divides your investment over the price range you’ve set, using 0.1 BTC for each grid. It will try to make a profit within this 1000 to 800 USDT range, grabbing more BTC as it does its thing.

3. Infinity grid trading

Think of it as an upgraded grid trading bot, designed to buy when prices are low and sell when they’re high. You can either let the bot decide things for itself or set things up on your own. If you want to be hands-on, you’ll pick three things: the lowest price you’re good with, how much money you’re putting in, and the profit you aim for each grid.

Here’s how it rolls:

Say the price starts climbing, like when there’s a buzz and everyone’s buying (that’s the start of a bull market). That’s a green signal to get the infinity grid bot into action. It’s a solid tool for making some USDT, so it’s a good idea to keep it around. As long as the price doesn’t dip below the lowest price you set, this bot keeps making trades.

4. Futures grid trading

Merging futures trading with grid bots has made this a favorite strategy for many. Why? Because it’s known for dishing out good profits while keeping risks on the lower side. And guess what? When the market’s really jumpy, your profits could climb even higher.

The idea here is simple: plan a price range for each grid and split your money into several bits. The grid bot is your trusty helper, automatically buying when prices are down and selling when they’re up. This back-and-forth of buying and selling is called arbitrage. So, every time prices bob up or down, this bot is on its toes, helping you pocket some profit. Plus, with the chance to amplify your returns using leverage (even up to a whopping 150x), it’s especially attractive.

If you’re the kind of trader looking to give your profits a boost through leverage, futures grid trading might be your jam. It’s a notch above regular spot trading because you can earn from the regular grid moves and scoop up some extra cash from the long side by paying funding fees. And if you’re thinking of betting on prices dropping, this method’s a winner. A lot of traders are gravitating towards Binance’s futures grid bots. And yup, top-notch platforms like TrailingCrypto are all for it and support these bots.

5. Long/short grid trading

Ever heard of following the trend? That’s the core of long/short grid trading. It lets you ride the waves of the market within a set grid. Here’s the deal: based on your analysis, you start with a position, then set buy and sell orders at specific points. The idea is to make the most out of the market’s ups and downs.

In the long grid approach, traders kick off with a long (or buy) position. On the flip side, the short grid strategy begins with a short (or sell) position.

Whether you’re new or a pro, grid trading is a tool everyone can use. It’s a smart way to handle your risks and boost your profits. If you’re someone eager to see quick gains, this method could be right up your alley.

Let’s talk about the downsides of grid trading.

Every investment method has its pitfalls, and grid trading in cryptocurrencies is no exception.

Mistakes in the algorithm or sudden, unexpected price changes? These could mean you end up losing all the money you put in.

Trading on grid platforms? Watch out for their steep fees. These eat into your profits and can amplify your losses.

Technical hiccups on grid platforms? They can mess up your trades or even result in lost funds.

And remember, some cryptocurrencies might not be easily traded on these platforms because of low activity. This makes buying or selling them a challenge.

Now, this doesn’t mean grid trading is a bad choice. But if you’re thinking of diving in, make sure you’re aware of the risks and smart about managing your investments.

Final Thoughts:

Grid trading is a smart approach for those aiming to earn while keeping risks in check. You get a system that trades on its own, cutting down on the chances of mistakes we humans might make and potentially boosting your overall earnings. But do not forget about its inherent disadvantages!

For those curious to dive deeper into the nuances of trading and explore a range of topics, there’s a wealth of information available. You can find insightful articles and discussions on our blog at “https://listing.help/blog“. Do swing by when you have a moment.

February 23, 2026

February 23, 2026