Gemini Listing Cost — How Much Does It Cost to List a Token in 2026?

October 19, 2025

October 19, 2025 Updated: January 4 2026, 10:06

Updated: January 4 2026, 10:06

LEAVE A REQUEST

Launching your own token project? Our experts are ready to help with listing on exchanges, market making, marketing and other solutions

SUBMIT APPLICATIONGemini is a U.S. regulated exchange supervised by the New York State Department of Financial Services (NYDFS). It does not sell listings and there is no official listing fee. However, getting listed requires exceptional compliance, security, custody readiness, and market integrity.

This guide clarifies the real 2026 costs and requirements for a Gemini listing: legal and regulatory work, security and custody, liquidity and market structure, and disclosures. You’ll also find a submission checklist, a step‑by‑step process, and a comparison with other U.S.‑focused exchanges.

What Is the Gemini Listing Cost in 2026?

Official exchange fee: $0. Gemini does not charge a listing fee. Teams should plan an end‑to‑end readiness budget across four buckets: legal & compliance, security & custody, liquidity & MM, and marketing.

Typical 2026 preparation ranges:

– Legal & compliance: $60K–$220K for legal opinions (e.g., Howey analysis), KYB/KYC, sanctions screening, disclosures, and potential state‑by‑state considerations.

– Security & custody: $30K–$140K for independent audits, custody integration, privileged‑role controls (multisig/timelocks), and monitoring.

– Liquidity & market‑making: $25K–$120K depending on pair strategy (e.g., USD/USDT/USDC vs Token), depth targets, and volatility.

– Marketing: $10K–$60K for brand, docs, website updates, PR, and data rooms.

Eligibility is driven by regulatory posture (legal clarity and disclosures), security and custody (independent audits, operational controls), and credible liquidity design (depth, spreads, abuse prevention).

Key Factors That Influence Gemini Acceptance and Timeline

Gemini prioritizes projects that demonstrate:

– Legal clarity: token classification, Howey considerations, disclosures and risk factors, jurisdictional fit, responsible persons with KYB/KYC.

– Security posture: smart contract audit report, remediation records, incident history, bug bounty, and operational controls.

– Custody & operations: qualified custody, wallet procedures, chain analysis, and incident runbooks.

– Liquidity design: target pairs, depth goals (<1–2% slippage at target trade size), MM policies, and circuit breakers.

– Data & disclosures: unified documents for tokenomics, unlocks/vesting, treasury policy, explorer links, and dashboards.

– Reputation signals: exchange performance elsewhere, governance maturity, and transparent communications.

Gemini vs. Other U.S.‑Focused Exchanges — What’s Different?

A concise comparison to plan your regulatory and technical track:

| Exchange | Official Fee | Primary Focus | Acceptance Drivers |

| Gemini | $0 | NYDFS‑regulated, compliance‑first onboarding | Legal clarity, security/custody, market integrity |

| Coinbase | $0 | U.S. retail + institutional reach | Compliance, security, product‑market fit |

| Kraken | $0 | U.S./EU reach, strong security | Compliance, security, liquidity and risk controls |

Gemini Requirements (2026 Checklist)

Pre‑submission checklist:

✅ Legal opinions and disclosures (classification, risks, unlocks/vesting, treasury addresses).

✅ Independent audits for protocol and token; verified source code; documented privileged roles and timelocks.

✅ Custody readiness: wallet procedures, multisig, incident response; chain analysis where applicable.

✅ Liquidity framework: target pairs (e.g., USD/USDT/USDC vs Token), depth targets, MM partner, abuse prevention.

✅ Unified data room: contracts, audits, addresses, tokenomics, dashboards, and contacts.

✅ Public communications: website/docs, brand assets, explorer links, and verified socials.

How to List a Token on Gemini — Step‑by‑Step

Operational sequence:

1) Engage U.S. counsel (possible through Listing.Help); prepare classification and risk disclosures; assemble KYB/KYC and sanctions attestations.

2) Complete independent audits; verify code; remove dangerous privileges; publish remediation notes.

3) Design pair strategy and depth targets; align MM policies and circuit breakers; ready liquidity reserves.

4) Prepare custody and operational controls; document wallet procedures and incident response.

5) Publish consistent public materials (website/docs/dashboards); assemble a clean data room and submit via the official channel or through a reliable partner (e.g. Listing.Help) to ensure a higher quality and faster launch.

6) Respond quickly to follow‑ups; keep data consistent; prepare for go‑live operations and monitoring.

Learn more about adding your token to Gemini in our other article.

Timeline and Practical Tips

– Prep (6–10+ weeks): legal opinions, audits, custody and liquidity planning.

– Review: varies with queue and document quality; faster for projects with clean data rooms and clear legal posture.

– Go‑live readiness: monitoring, abuse prevention, user communications, and support.

Tip: maintain one public source of truth for all addresses, audits, and unlock schedules to reduce back‑and‑forth.

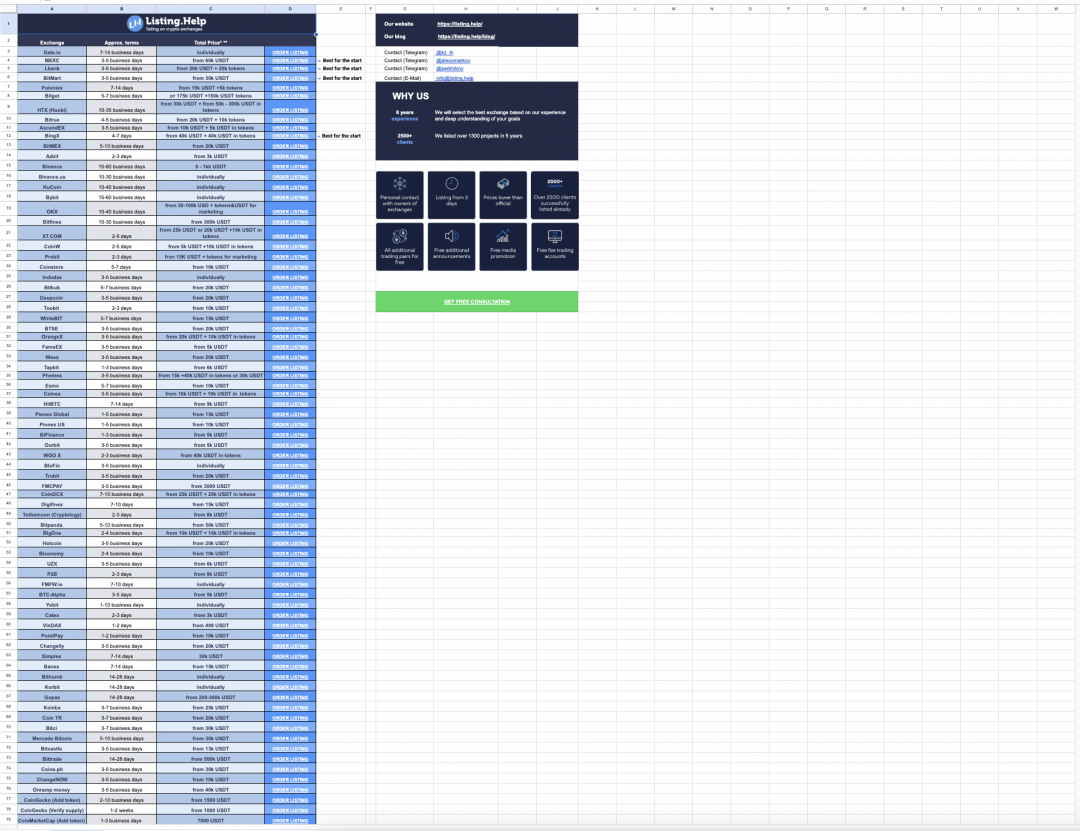

With an agency like Listing.Help, you can get listed on an exchange faster.

January 28, 2026

January 28, 2026